More Optimistic Pay, Bonus and Headcount Outlook in 2014

Study finds Asset Management business in Asia is more bullish about pay, bonus and headcount versus other sectors in the financial industry

HONG KONG, December 3, 2013 -- Asian firms are more optimistic in increasing pay, bonus and headcount due to better business performance according to niche management consulting firm, Pretium Partners Asia Limited ("Pretium").

The Pretium Year-end Rewards and Performance Trends Study in 2013 for leading financial institutions shows bonus pool for Asset Management business will likely increase by around 10% or more due to reasonably better anticipated business performance. Bonus in Wealth Management and Alternative Management is forecasted to slightly go up by around 5% due to increase in asset under management (AUM) and hiring in Asia. Bonus for Insurance is predicted to be flat to slightly up, whereas Investment Banking and Capital Markets will be largely flat, i.e. similar to the overall firm-wide bonus pool. Generally speaking, Asian firms especially Chinese firms will be slightly better than their international counterparts.

The study was conducted in November 2013 to examine the reward and performance trends in Asia, including business performance expectations, expected salary review budget, bonus pool movements, headcount changes and reactions to global regulatory changes on compensation in 2013. A good mix of international and Asian investment banks, asset management and private equities firms as well as insurance companies provided their expectation and forecasts.

It is expected salaries for employees of the financial industry in Hong Kong will increase by 5%, slightly more than their counterparts in Singapore (4%). Employees in China will have their salaries increased by 6% to reflect the surging staff costs. Salary increase forecast tends to be even higher for other emerging countries like Indonesia (10%) and India (8%). Employees in Japan will have 2% increases as a result of higher than expected inflation, just slightly below the 3% increase for their Taiwanese and Australian counterparts.

"Asset Management is relatively more upbeat due to increase in AUM and further widening of RQFII products for Chinese firms," said May Poon, Partner at Pretium. "However, depending on the business set-up, firms in Asia tend to indicate that their firm-wide bonus pools to be flat compared with last year after taking into consideration of their global/regional performance, performance variation of various business sectors and increasing fixed costs, such as compensation and benefits, technology investment, etc."

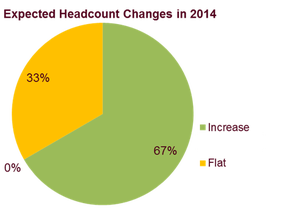

The study also shows more optimistic headcount increase in Asia for 2014 as more than two-thirds of the surveyed financial institutions have planned 5% to 10% headcount increase. No surveyed firms indicate any headcount reduction plan for 2014. The increase will mostly focus on Asset/Wealth Management, Alternative Investment as well as Risk and Compliance functions. The surging demand for Risk and Compliance talent aligns with growing awareness on risk mitigation among Asian firms.

Study finds Asset Management business in Asia is more bullish about pay, bonus and headcount versus other sectors in the financial industry

HONG KONG, December 3, 2013 -- Asian firms are more optimistic in increasing pay, bonus and headcount due to better business performance according to niche management consulting firm, Pretium Partners Asia Limited ("Pretium").

The Pretium Year-end Rewards and Performance Trends Study in 2013 for leading financial institutions shows bonus pool for Asset Management business will likely increase by around 10% or more due to reasonably better anticipated business performance. Bonus in Wealth Management and Alternative Management is forecasted to slightly go up by around 5% due to increase in asset under management (AUM) and hiring in Asia. Bonus for Insurance is predicted to be flat to slightly up, whereas Investment Banking and Capital Markets will be largely flat, i.e. similar to the overall firm-wide bonus pool. Generally speaking, Asian firms especially Chinese firms will be slightly better than their international counterparts.

The study was conducted in November 2013 to examine the reward and performance trends in Asia, including business performance expectations, expected salary review budget, bonus pool movements, headcount changes and reactions to global regulatory changes on compensation in 2013. A good mix of international and Asian investment banks, asset management and private equities firms as well as insurance companies provided their expectation and forecasts.

It is expected salaries for employees of the financial industry in Hong Kong will increase by 5%, slightly more than their counterparts in Singapore (4%). Employees in China will have their salaries increased by 6% to reflect the surging staff costs. Salary increase forecast tends to be even higher for other emerging countries like Indonesia (10%) and India (8%). Employees in Japan will have 2% increases as a result of higher than expected inflation, just slightly below the 3% increase for their Taiwanese and Australian counterparts.

"Asset Management is relatively more upbeat due to increase in AUM and further widening of RQFII products for Chinese firms," said May Poon, Partner at Pretium. "However, depending on the business set-up, firms in Asia tend to indicate that their firm-wide bonus pools to be flat compared with last year after taking into consideration of their global/regional performance, performance variation of various business sectors and increasing fixed costs, such as compensation and benefits, technology investment, etc."

The study also shows more optimistic headcount increase in Asia for 2014 as more than two-thirds of the surveyed financial institutions have planned 5% to 10% headcount increase. No surveyed firms indicate any headcount reduction plan for 2014. The increase will mostly focus on Asset/Wealth Management, Alternative Investment as well as Risk and Compliance functions. The surging demand for Risk and Compliance talent aligns with growing awareness on risk mitigation among Asian firms.

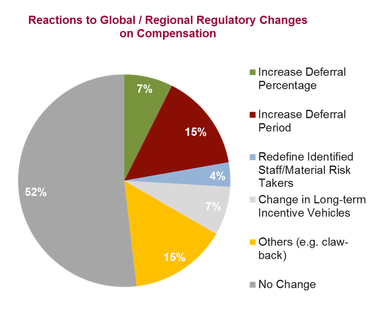

Almost half of the surveyed firms have strengthened their long-term incentive (LTI) plans in 2013. About one-third of the firms have either adjusted the bonus deferral period to 3 years or introduced claw-back and malus provisions to their LTI plans. In Asia, though regulators are less restrictive in regulatory requirements and have yet to introduce bonus caps as advocated by Europe/UK, there have been clear and consistent efforts in strengthening the reward strategy / programs so as to be more compliant with the pay-for-performance spirit behind the regulations.

"Bonus caps in Europe/UK will inevitably drive bankers to Asia which provides excellent opportunities for Asian firms to source good talent for their significant headcount growth in 2014,” said May. “More Asian firms, in particular the Chinese ones, have planned to align the deferral schedule to the three-year market norm and introduce claw-back / malus provisions to demonstrate the pay-for-performance culture and align with the regulatory spirit."

About the Pretium 2013 Year-end Reward and Performance Trends Study

The Pretium 2013 Year-end Reward and Performance Trends Study examined the reward and performance trends in Asia, including business performance expectations, expected salary review budget and bonus pool movements, headcount changes and reactions to global regulatory changes on compensation in 2013. Through inputs collected across various sectors from reputable firms of the financial industry together with our consultants’ in-depth market understanding, Pretium would be able to derive valuable market insights and articulate the forward-thinking outlook on the business performance and compensation for the industry.

About Pretium Partners Asia Limited

Pretium Partners Asia Limited ("Pretium") is a niche management consulting firm with strong financial industry expertise supported by extensive experience in clients’ projects and ongoing proprietary researches. Pretium helps accelerate clients' growth and increase profitability through unique spectrum of management consulting services which includes incentive plan review and design, organization transformation, business performance management, mergers & acquisitions, and benchmarking.

About the Pretium 2013 Year-end Reward and Performance Trends Study

The Pretium 2013 Year-end Reward and Performance Trends Study examined the reward and performance trends in Asia, including business performance expectations, expected salary review budget and bonus pool movements, headcount changes and reactions to global regulatory changes on compensation in 2013. Through inputs collected across various sectors from reputable firms of the financial industry together with our consultants’ in-depth market understanding, Pretium would be able to derive valuable market insights and articulate the forward-thinking outlook on the business performance and compensation for the industry.

About Pretium Partners Asia Limited

Pretium Partners Asia Limited ("Pretium") is a niche management consulting firm with strong financial industry expertise supported by extensive experience in clients’ projects and ongoing proprietary researches. Pretium helps accelerate clients' growth and increase profitability through unique spectrum of management consulting services which includes incentive plan review and design, organization transformation, business performance management, mergers & acquisitions, and benchmarking.